nj 529 contributions tax deductible

Web New Jersey does not offer a deduction for 529 plan contributions. Taxpayers can deduct up to 15000 for individuals in contributions to any 529 plan per beneficiary each year.

20 tax credit on.

. Web Tax Deductions for New Jersey Families. Also question is how much of 529 is tax deductible. However some states may consider 529 contributions tax deductible.

The plan NJBEST is offered through Franklin Templeton. Web 36 rows Ohio offers married taxpayers a state tax deduction for 529 plan contributions of up to 4000 per year for each beneficiary. Web New Jersey College Affordability Act.

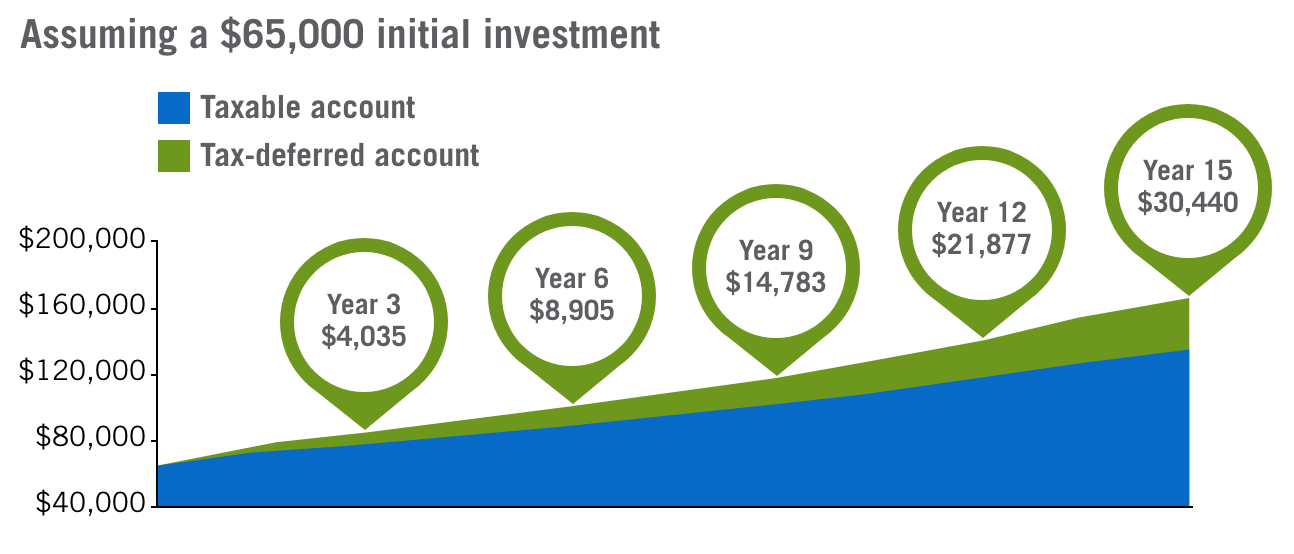

However tax savings is not the only thing to focus on. Up to 10000 per year may be withdrawn from 529 savings plans federal income tax-free if used for tuition expenses at private public and. Contributions to such plans are not deductible but the money grows tax-free.

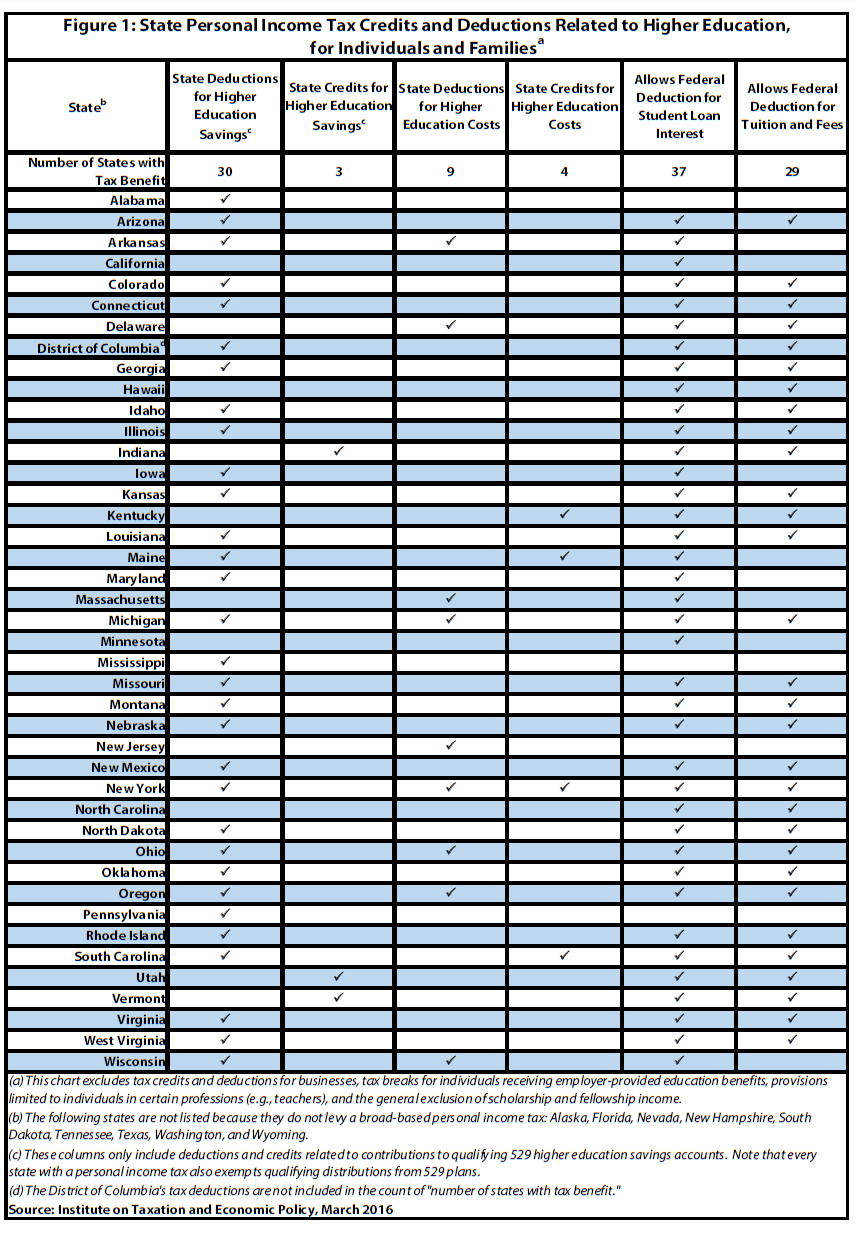

Taxpayers can deduct up to 15000. Web Many states that offer a deduction for contributions impose a deduction cap or limitation on the amount of the deduction. Web State-by-state outline of the various state section 529 plan deductions.

To your question for both plans - and for other non-New. But if you live in New York and pay New York state income taxes you may be able to deduct the. As of January 2019 there are no tax deduction benefits when making a.

Web The New Jersey tax savings is approximately 500. Web In seven states California Kentucky Delaware New Jersey North Carolina Maine and Hawaii no deductions are available while another nine have no. State income tax benefit.

For example if you contribute 10000. Web Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions. Web State income tax benefit.

Web New Jerseys NJBEST 529 College Savings Plan is managed by Franklin Templeton and features age-based and static portfolio options utilizing mutual funds andor ETFs along. Beginning with Tax Year 2022 filed in 2023 the New Jersey College Affordability Act allows for three Income Tax deductions. Check with your 529 plan or.

Web Also under the New Jersey College Affordability Act if you earn 75000 or less a year you may be eligible for up to 750 given as a matching grant for amounts you. Never are 529 contributions tax deductible on the federal level. Management fees annual fees and performance are other.

Married couples filing jointly. Unlike traditional IRAs and 401 ks 529 plan contributions are not tax deductible at the federal level. A 529 plan is designed to help save for college.

Web Section 529 - Qualified Tuition Plans. Web Contributions are not tax deductible. Web 455New Yorktax deductiondeduction529taxtax.

Web Unfortunately she said neither plan allows you to make any sort of tax-deductible contribution. Web New Jerseys plan doesnt offer much. Visit individual plan websites for current information about fund expenses minimum.

Can I Use A N Y 529 Plan Even Though I Live In N J Nj Com

Higher Education Income Tax Deductions And Credits In The States Itep

Tax Benefits Nest Advisor 529 College Savings Plan

What Is A 529 Plan Marcus By Goldman Sachs

529 Plan Tax Rules By State Invesco Us

529 Tax Benefits By State Invesco Invesco Us

Determining How Much To Contribute To A 529 Plan Not Too Much

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

How Much Are 529 Plans Tax Benefits Worth Morningstar

Can You Get A 529 Plan Tax Deduction

529 Plans Which States Reward College Savers Adviser Investments

Nj College Affordability Act What You Need To Know Access Wealth

An Alternative To 529 Plan Superfunding

The Best 529 Plans Of 2022 Forbes Advisor

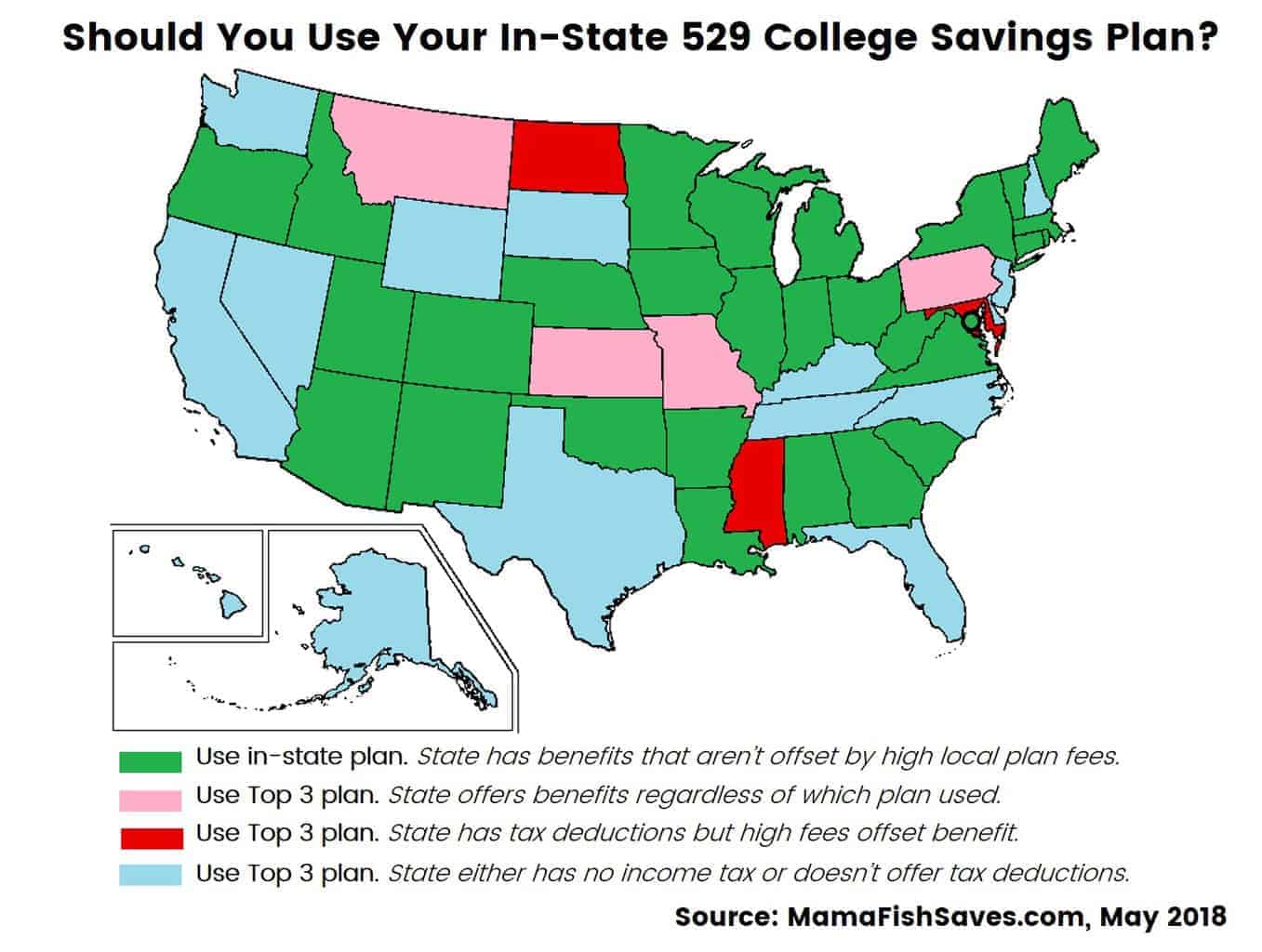

Choosing The Best 529 College Savings Plan For Your Family Smart Money Mamas

How Much Are 529 Plans Tax Benefits Worth Morningstar